How Much Do Brokers Charge to Sell a Business: Complete Pricing Breakdown. Selling a business is one of the most significant financial decisions an entrepreneur can make, and understanding how much brokers charge to sell a business is crucial for making informed choices about your exit strategy. Business brokers serve as intermediaries who connect sellers with qualified buyers, manage negotiations, and guide the entire transaction process from valuation to closing.

The cost structure for business broker services can vary dramatically based on multiple factors including business size, industry complexity, and the type of brokerage firm you choose. Most business owners find themselves navigating between percentage-based commissions, upfront retainer fees, and additional service charges that can significantly impact their net proceeds from the sale.

Understanding Business Broker Commission Structures

Percentage-Based Commission Models

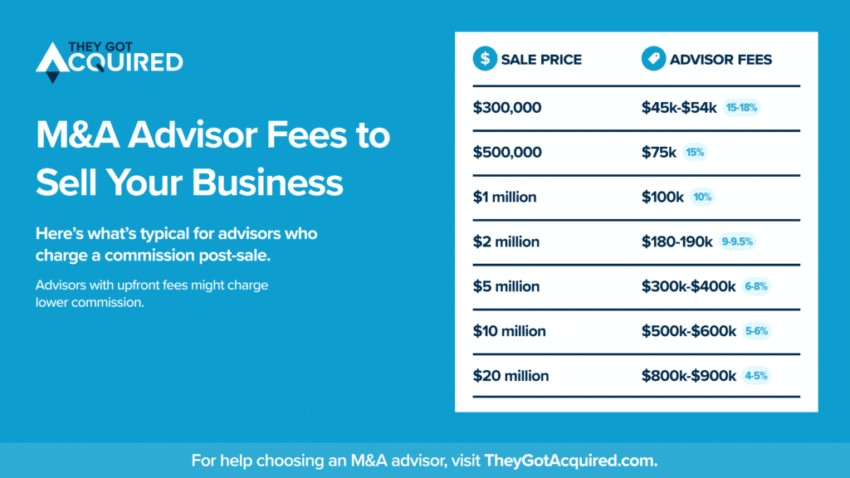

The most common fee structure involves brokers earning a percentage of the ultimate sale price as their commission, typically ranging from 5% to 15%. This performance-based model aligns the broker’s interests with yours, as they only get paid when your business successfully sells.

For main street businesses (typically those with revenues under $1 million), commission rates usually fall between 8% and 10% of the sales price. These smaller businesses often require more intensive marketing efforts and longer sales cycles, justifying the higher percentage rates.

Mid-market businesses with revenues between $1 million and $10 million typically see commission rates in the 6-10% range, while larger enterprises may negotiate lower percentages due to the higher absolute dollar amounts involved in the transaction.

Tiered Commission Structures

Many brokers implement sliding scale commission structures, particularly for higher-value businesses. A common tiered structure might include 5% on the first million, 4% on the second million, 3% on the third million, and 2% on everything over $3 million. This approach recognizes that larger deals often require proportionally less work per dollar of transaction value.

Example Commission Calculation:

- Business Sale Price: $2.5 million

- First $1M: $1,000,000 × 5% = $50,000

- Second $1M: $1,000,000 × 4% = $40,000

- Remaining $500K: $500,000 × 3% = $15,000

- Total Commission: $105,000

Fixed Fee Arrangements

Flat fees are common for small businesses valued under $100,000, where percentage-based commissions might not provide adequate compensation for the broker’s time and effort. These fixed arrangements typically range from $10,000 to $50,000 depending on the complexity of the transaction.

Upfront Fees and Retainer Costs

Retainer Fee Structures

In certain instances, brokers stipulate upfront retainer fees, which are non-refundable sums tendered to secure the broker’s services. These retainers serve multiple purposes: they demonstrate the seller’s commitment to the process and provide the broker with immediate compensation for initial work.

Retainer fee ranges by business size:

- Small businesses (under $1M revenue): $2,500 – $10,000

- Mid-market businesses ($1M-$10M): $5,000 to $15,000 upfront or in monthly payments

- Large businesses ($10M+): $25,000 to $50,000

The retainer fee usually is deducted from the eventual commission upon completion of the transaction, meaning it’s not an additional cost but rather an advance payment against future commission.

Valuation and Assessment Fees

Business brokers may impose a fee for conducting a thorough business valuation. Professional business valuations are essential for setting realistic asking prices and providing credibility to potential buyers.

Valuation fee structure:

- Basic valuations: $2,500 – $5,000

- Comprehensive valuations: $5,000 – $15,000

- Complex multi-location businesses: $15,000+

Monthly Retainer Models

Some brokers prefer monthly arrangements with assignments capped at a certain number of months, with opportunities to extend should both parties agree. Monthly retainers typically range from $3,000 to $10,000 per month, depending on the business size and complexity.

Factors Affecting Business Broker Pricing

Business Size and Complexity

The size of your business significantly impacts how much brokers charge to sell a business. Larger businesses often command lower percentage rates but higher absolute fees due to their complexity and longer sales cycles.

Complexity factors include:

- Multiple locations or divisions

- Specialized industry knowledge requirements

- Complex financial structures

- Regulatory compliance issues

- Extensive due diligence requirements

Industry Specialization

In some industries, commission rates can be as high as 20%, particularly in specialized sectors requiring extensive industry knowledge or regulatory expertise. Industries with higher complexity or specialized buyer pools often justify premium pricing structures.

High-commission industries typically include:

- Healthcare practices

- Technology companies with intellectual property

- Manufacturing with environmental considerations

- Financial services requiring regulatory approval

Geographic Market Conditions

Local market conditions significantly influence broker pricing strategies. Competitive markets with multiple qualified brokers may offer more favorable fee structures, while specialized markets with limited expertise may command premium rates.

Transaction Urgency

Sellers requiring expedited sales processes may face premium pricing due to the intensive marketing efforts and accelerated timelines required. Rush transactions often require brokers to prioritize your sale over other listings, justifying higher fees.

Different Types of Brokers and Their Fee Structures

Independent Business Brokers

Independent brokers often charge higher commissions (8–12%) due to their personalized, hands-on approach, with some also requiring retainers upfront. These brokers typically offer more personalized service but may have limited marketing reach compared to larger firms.

Advantages of independent brokers:

- Personalized attention and service

- Flexible fee negotiations

- Industry specialization

- Local market expertise

Large Brokerage Firms

Large brokerage firms typically serve mid-market businesses and often provide more comprehensive marketing platforms and buyer networks. While their commission rates may be similar to independent brokers, they often offer additional resources and support services.

Benefits of large firms:

- Extensive buyer databases

- National marketing reach

- Specialized support teams

- Established transaction processes

Investment Banks and M&A Advisors

For larger transactions typically exceeding $10 million in value, investment banks usually have minimum fees ranging from $50,000 to $250,000, with the most common fee structures being the Lehman and Double Lehman formulas.

Lehman Formula Structure:

- 5% on first $1 million

- 4% on second $1 million

- 3% on third $1 million

- 2% on fourth $1 million

- 1% on amounts over $4 million

Hidden Costs and Additional Expenses

Marketing and Advertising Costs

While basic marketing is typically included in broker commissions, premium marketing services may incur additional costs:

- Professional photography: $500 – $2,000

- Virtual tours and videos: $1,000 – $5,000

- Premium listing placements: $1,000 – $10,000

- Industry-specific advertising: $2,000 – $15,000

Due Diligence Support

Complex transactions may require additional professional services:

- Financial statement preparation: $2,000 – $10,000

- Legal document review: $3,000 – $15,000

- Environmental assessments: $5,000 – $25,000

- Technology audits: $3,000 – $20,000

Transaction Coordination Fees

Some brokers charge separate fees for transaction coordination services, particularly for complex deals requiring extensive documentation and compliance work. These fees typically range from $2,000 to $15,000 depending on transaction complexity.

Negotiating Business Broker Fees

Key Negotiation Strategies

Like everything in business, broker fees are not set in stone, and there’s always room for negotiation. Successful fee negotiations require understanding market conditions, broker capabilities, and your business’s attractiveness to potential buyers.

Effective negotiation tactics:

- Compare multiple broker proposals

- Negotiate based on business complexity

- Consider performance-based incentives

- Discuss retainer credit arrangements

- Evaluate total cost vs. expected outcomes

Performance Incentives

Consider structuring deals with performance bonuses for achieving certain milestones:

- Premium pricing bonuses (additional 0.5-1% for exceeding target price)

- Timeline bonuses (reduced commission for quick sales)

- Multiple offer bonuses (incentives for generating competitive bidding)

Exclusive vs. Non-Exclusive Agreements

Exclusive agreements typically offer better service and marketing commitment but may limit your negotiating power. Non-exclusive arrangements provide flexibility but may result in less dedicated service from brokers.

When to Consider Alternative Fee Structures

Flat Fee Services

For straightforward business sales with clear valuations and strong market demand, flat fee services may provide cost savings. These arrangements work best for:

- Established businesses with strong financials

- Simple ownership structures

- Active buyer markets

- Experienced business owners

Success Fee Only Models

Pure success fee models (no upfront costs) are becoming more common, particularly for attractive businesses in competitive markets. These arrangements align broker incentives completely with seller outcomes but may result in higher commission percentages.

Hybrid Arrangements

Some brokers offer hybrid models combining reduced commissions with upfront fees, providing balance between risk-sharing and immediate compensation. These arrangements often work well for medium-sized businesses with moderate complexity.

Maximizing Value from Your Broker Investment

Selecting the Right Broker

Understanding how much brokers charge to sell a business is only part of the equation. The value provided by your chosen broker should justify their fee structure through:

- Market expertise and industry knowledge

- Proven track record of successful sales

- Comprehensive marketing strategies

- Strong buyer networks and relationships

- Professional transaction management

Preparing Your Business for Sale

Working with brokers to properly prepare your business can significantly impact both sale price and timeline:

Key preparation areas:

- Financial statement organization

- Operational procedure documentation

- Customer relationship management

- Employee retention strategies

- Asset condition and maintenance

Managing the Sale Process

Active participation in the sale process can help maximize broker value:

- Regular communication and updates

- Prompt response to buyer inquiries

- Professional presentation during showings

- Flexibility in negotiation processes

Regional Variations in Broker Fees

Metropolitan vs. Rural Markets

Urban markets typically offer more competitive broker pricing due to higher transaction volumes and more brokers competing for business. Rural markets may have limited broker options, potentially resulting in higher fees but more personalized service.

State and Local Regulations

Different states have varying regulations affecting broker licensing, disclosure requirements, and fee structures. Some jurisdictions have specific rules regarding retainer fees or commission caps that may impact your total costs.

Note: Just as you might research pricing for specialized equipment like a motorcycle battery charger, it’s essential to thoroughly research and compare broker fees in your specific market.

Industry-Specific Considerations

Restaurant and Food Service Businesses

Food service businesses often face unique challenges that may justify premium broker fees:

- Health department compliance

- Liquor license transfers

- Lease assignment complexities

- Equipment valuations

Professional Service Firms

Law firms, medical practices, and consulting businesses require brokers with specialized knowledge of:

- Client transition agreements

- Professional licensing requirements

- Non-compete arrangements

- Goodwill valuations

Manufacturing and Distribution

Industrial businesses involve complex considerations affecting broker compensation:

- Equipment and machinery valuations

- Environmental compliance issues

- Supply chain relationships

- Zoning and regulatory matters

Technology and Modern Broker Services

Digital Marketing Platforms

Modern brokers leverage technology to provide enhanced marketing services that may justify higher fees:

- Professional listing websites

- Social media marketing campaigns

- Virtual reality property tours

- AI-powered buyer matching

Transaction Management Systems

Advanced brokers use sophisticated systems for:

- Document management and sharing

- Communication tracking

- Due diligence coordination

- Progress monitoring and reporting

International and Cross-Border Transactions

Additional Complexity Factors

Cross-border business sales involve additional complexities that typically result in higher broker fees:

- Currency exchange considerations

- International tax implications

- Regulatory compliance across jurisdictions

- Cultural and language barriers

Specialized Expertise Requirements

International transactions often require brokers with specific expertise in:

- Foreign investment regulations

- Cross-border financing structures

- International buyer networks

- Cultural negotiation differences

Frequently Asked Questions

What is the average commission rate brokers charge to sell a business?

In percentage-based models, fees usually range from 8% to 12% of the final sale price, with smaller businesses typically paying higher percentages and larger businesses negotiating lower rates through tiered structures.

Do all brokers require upfront fees when selling a business?

Not all brokers require upfront fees, but many do charge retainer fees or valuation costs. Almost all sellers will be expected to pay an upfront valuation and/or marketing fee, and it’s not unusual for business owners to be required to pay a monthly retainer fee.

How much should I expect to pay in total broker fees to sell my business?

Total costs typically range from 8-15% of the sale price for commission plus $5,000-$50,000 in upfront fees, depending on your business size and complexity. A $1 million business sale might cost $80,000-$150,000 in total broker fees.

Can broker commission rates be negotiated when selling a business?

Yes, broker fees are negotiable. Since everything is negotiable, your pricing and fees may vary based on factors like market conditions, business attractiveness, and broker competition in your area.

What’s the difference between broker fees for small vs. large business sales?

Smaller businesses typically pay higher percentage rates (8-12%) while larger businesses may negotiate tiered structures or lower percentages. However, larger businesses often face higher upfront costs for valuations and due diligence support.

Are broker retainer fees refundable if my business doesn’t sell?

Retainer fees are typically non-refundable sums tendered to secure the broker’s services, though they are usually deducted from the eventual commission upon completion of the transaction.

How do investment bank fees differ from business broker charges?

Investment banks usually have minimum fees ranging from $50,000 to $250,000 and commonly use Lehman or Double Lehman formulas, while traditional business brokers typically charge percentage-based commissions without minimum fees.

What additional costs should I budget beyond broker commissions when selling?

Beyond broker fees, budget for legal costs ($5,000-$25,000), accounting fees ($3,000-$15,000), potential business improvements ($10,000-$100,000+), and marketing expenses if not included in broker services.

Ready to explore your options? Understanding how much brokers charge to sell a business is the first step in making informed decisions about your exit strategy. Compare multiple broker proposals, negotiate fees based on your business’s unique characteristics, and choose a partner whose expertise justifies their pricing structure.

Source: Business Broker Fee Structures and Industry Standards