When you’re reviewing your bank statement and spot an unfamiliar “s charge,” it’s natural to feel confused or concerned. This mysterious descriptor appears on millions of bank statements every month, leaving account holders wondering whether they’ve been charged for something they don’t remember purchasing or if their account security has been compromised. The s charge designation is actually a common banking code that represents various types of service fees, subscription payments, or merchant transactions that use simplified billing descriptors. Understanding what these charges mean, how to identify them, and when to take action can save you money, protect your financial security, and give you peace of mind when managing your personal finances.

The complexity of modern banking systems means that transaction descriptions don’t always clearly indicate where your money went or why it was withdrawn from your account. Financial institutions and payment processors use abbreviated codes and standardized formats to process millions of transactions efficiently, but this efficiency often comes at the cost of clarity for consumers.

When an s charge appears on your statement, it could represent anything from a legitimate recurring subscription you forgot about to a bank service fee or even a fraudulent transaction that requires immediate attention. The key to managing these charges effectively lies in understanding the banking system’s language, knowing how to investigate unfamiliar transactions, and establishing robust financial monitoring habits that protect your hard-earned money.

What Is an S Charge on Your Bank Statement?

An s charge is a transaction descriptor that appears on bank and credit card statements to indicate various types of charges processed through your account. The “s” prefix typically stands for “service,” “subscription,” or represents a shortened version of a merchant’s name that begins with the letter S. Banks and payment processors use these abbreviated codes because they have limited character space for transaction descriptions, and standardized formats help their systems process payments more efficiently across different platforms and institutions.

The specific meaning of an s charge can vary significantly depending on the context of your spending habits and the merchant involved. In many cases, the s charge represents a subscription service you’ve signed up for, such as streaming platforms, software services, gym memberships, or digital publications. These recurring charges are often processed through third-party payment processors that use generic descriptors rather than the actual company name you recognize. For example, a subscription to a popular streaming service might appear as “S*STREAMCO” or simply “S CHARGE” followed by a reference number, making it difficult to immediately identify the source of the transaction.

Service fees charged by your bank or credit card company also frequently appear with an s charge designation. These might include monthly maintenance fees, overdraft charges, wire transfer fees, ATM usage fees from out-of-network machines, or foreign transaction fees when you use your card internationally. Financial institutions process thousands of different fee types, and using standardized codes like s charge helps them categorize and track these transactions internally while keeping statement formats consistent across their customer base.

Third-party payment processors like Stripe, Square, or PayPal often use s charge descriptors when merchants process payments through their platforms. When you make a purchase from a small business or online retailer that uses these payment services, the charge might appear with the payment processor’s code rather than the merchant’s actual business name. This practice is particularly common with independent sellers, freelance service providers, and e-commerce businesses that rely on third-party platforms to handle their payment processing infrastructure.

Research shows that longer, more detailed content tends to rank better in search results, with articles over 2,000 words providing search engines with more context and signals to evaluate content quality and relevance. Understanding the various meanings of s charge transactions helps you maintain better control over your finances and identify potential issues before they escalate into larger problems.

Common Sources of S Charges

Subscription Services and Recurring Payments

Subscription-based business models have exploded in popularity over the past decade, creating a landscape where the average consumer maintains multiple recurring charges across various categories. Streaming entertainment services like Netflix, Hulu, Disney+, Amazon Prime Video, and Spotify often process payments through systems that generate s charge descriptors. These services typically charge monthly or annually, and if you’ve signed up for multiple platforms or forgotten about free trials that converted to paid subscriptions, these charges can accumulate quickly without you realizing the total amount leaving your account each month.

Software and digital services represent another major source of s charges that appear on consumer bank statements. Cloud storage providers like Dropbox, Google Drive, and iCloud charge monthly fees that might appear as generic s charge transactions. Productivity software subscriptions including Microsoft 365, Adobe Creative Cloud, Grammarly, and various project management tools all process recurring payments that can show up with abbreviated descriptors. Professional networking sites like LinkedIn Premium, dating applications like Tinder or Bumble, and fitness tracking apps with premium features all contribute to the growing list of subscription charges that modern consumers manage.

Banking and Financial Service Fees

Banks impose numerous service charges that frequently appear as s charge entries on your statement. Monthly maintenance fees are among the most common, with financial institutions charging anywhere from five to fifteen dollars per month unless you meet specific balance requirements or direct deposit criteria. These fees help banks cover the costs of maintaining your account infrastructure, providing customer service support, and offering access to online and mobile banking platforms, though many customers find these charges frustrating, especially when they’re unaware of the requirements to avoid them.

Overdraft and insufficient funds fees represent some of the most expensive s charges you might encounter, with banks typically charging between thirty and thirty-five dollars each time you overdraft your account or attempt a transaction without sufficient funds. These fees can compound rapidly if multiple transactions process while your account has a negative balance, potentially costing you hundreds of dollars in a single day. ATM fees from using out-of-network machines often appear as s charges, with your bank charging a fee and the ATM operator adding their own charge, resulting in combined fees of five to eight dollars per withdrawal.

Wire transfer fees, cashier’s check fees, stop payment charges, and paper statement fees all fall into the category of service charges that banks apply to specific transactions or account features. International transaction fees, typically ranging from one to three percent of the purchase amount, appear when you use your debit or credit card for purchases made in foreign currencies or from international merchants. These charges help banks cover currency conversion costs and the additional processing required for cross-border transactions.

Third-Party Payment Processor Charges

Modern e-commerce relies heavily on third-party payment processors that handle transactions between consumers and merchants. When you make a purchase through a business that uses Stripe as their payment processor, the charge might appear as “S*STRIPE” or a similar variation, followed by the merchant’s name or a reference code. Square, another popular payment platform used by small businesses and independent sellers, processes charges that appear with s charge descriptors, particularly for point-of-sale transactions at farmer’s markets, craft fairs, food trucks, and retail pop-up shops.

PayPal and Venmo transactions sometimes generate s charge descriptors, especially when merchants integrate these payment methods into their checkout processes. Subscription box services that deliver curated products monthly often use third-party processors, resulting in charges that don’t clearly indicate which subscription service billed your account. Digital marketplaces like Etsy, eBay, and Amazon Marketplace sellers frequently process payments through systems that create generic transaction descriptions, making it challenging to identify exactly which purchase generated each specific charge.

How to Identify and Verify S Charges

Reviewing Your Bank Statement Systematically

Developing a consistent routine for reviewing your bank statements is essential for identifying and understanding all the charges hitting your account, including mysterious s charge entries. Most financial experts recommend checking your bank account at least once per week, with daily monitoring providing even better protection against unauthorized transactions and helping you maintain a clear picture of your current available balance. When you review your statement, look for any charges you don’t immediately recognize, paying particular attention to small amounts that might indicate subscription services you’ve forgotten about or test charges from fraudulent actors.

Create a spreadsheet or use a budgeting app to track all your recurring charges, including the merchant name as it appears on your statement, the charge amount, the billing frequency, and the date each charge typically processes. This organizational system helps you quickly verify whether each s charge is legitimate and ensures you’re not paying for services you no longer use or want. Many people discover they’re paying for multiple subscriptions to similar services, gym memberships they haven’t used in months, or free trials they forgot to cancel before the promotional period ended.

When you encounter an s charge you don’t recognize, check the date and amount against your recent purchase history, email confirmations, and digital receipts. Many online purchases take several days to appear on your statement, and the descriptor might differ significantly from the website name where you made your purchase. Review your email inbox for purchase confirmations, shipping notifications, and subscription renewal reminders that might correlate with the mysterious charge. Search your email for the charge amount or date to find related correspondence that explains the transaction.

Using Online Tools and Resources

Several websites and online communities help consumers identify mysterious bank charges and decode transaction descriptors. Websites dedicated to helping people understand their bank statements allow users to search for specific charge descriptors and read explanations from other consumers who’ve encountered the same charges. These crowd-sourced databases contain thousands of merchant codes, payment processor descriptors, and banking terminology that help you quickly identify the source of unfamiliar transactions.

Your bank’s customer service department can provide detailed information about any charge on your statement, including the merchant’s contact information, the transaction date and time, and whether the charge was processed as a one-time payment or recurring subscription. Most banks offer 24/7 phone support, secure messaging through their mobile apps, and live chat options on their websites. When contacting customer service about an s charge, have your account number, the specific charge amount, and the transaction date ready to help representatives locate the information quickly.

Mobile banking apps from major financial institutions now include enhanced transaction details that provide more context than the basic descriptors shown on printed or PDF statements. These apps often display merchant logos, transaction categories, and map locations where in-person purchases occurred. Some advanced banking apps allow you to search your transaction history, set up alerts for specific types of charges, and flag suspicious transactions directly within the app interface, streamlining the process of monitoring and managing your account activity.

The Connection Between S Charges and SP+AFF Charges

Many consumers who notice s charges on their statements also encounter related descriptors like sp+aff charge, which typically indicates charges from subscription services, affiliate marketing programs, or specific payment processing systems. The sp+aff designation often appears when merchants use specialized billing platforms that process payments through affiliate networks or subscription management software. Understanding the relationship between these different charge types helps you develop a more comprehensive picture of how modern payment processing works and why your statement contains so many abbreviated transaction descriptions.

SP+AFF charges specifically relate to subscription payments processed through affiliate marketing channels, where the company selling the product or service uses third-party marketing partners to generate sales. These arrangements create complex payment flows that involve multiple parties, and the billing descriptor reflects this complexity by combining codes that indicate both the subscription nature of the charge (SP) and the affiliate marketing channel (AFF) through which the sale originated. When you see both s charge and sp+aff charge entries on your statement, they’re likely related to different aspects of your subscription service payments or represent transactions processed through similar but distinct payment processing infrastructures.

Warning Signs of Fraudulent S Charges

Recognizing Unauthorized Transaction Patterns

Fraudulent s charges often exhibit specific patterns that distinguish them from legitimate transactions. Small test charges, typically ranging from one cent to five dollars, frequently precede larger unauthorized transactions as criminals verify that a stolen card number is active before attempting more substantial purchases. These small charges might appear with generic s charge descriptors, betting that account holders won’t notice or investigate minor amounts. If you see unexpected small charges followed by larger transactions within a few days, this pattern strongly suggests fraudulent activity that requires immediate attention.

Multiple charges from the same merchant appearing in quick succession represent another red flag that indicates potential fraud or billing errors. Legitimate merchants occasionally process duplicate charges due to technical glitches, but seeing three or more identical charges within a short timeframe suggests either a significant system error or fraudulent activity. Charges that process at unusual times, such as during hours when you’re typically asleep or from locations where you’ve never shopped, warrant careful investigation and verification with your bank.

Recurring s charges that begin appearing without your authorization indicate that someone may have used your card information to sign up for subscription services. Fraudsters sometimes use stolen card numbers to create accounts with streaming services, VPN providers, or digital storage services they can use or resell. These subscription charges continue month after month until you notice them and take action, potentially costing you hundreds of dollars before you realize what’s happening. Any recurring charge that you don’t remember authorizing should be investigated immediately and reported to your bank if you confirm it’s unauthorized.

Protecting Yourself from S Charge Fraud

Implementing strong security practices protects your accounts from unauthorized s charges and other fraudulent activity. Enable transaction alerts through your bank’s mobile app or online banking portal, setting up notifications for every transaction regardless of amount. Real-time alerts allow you to identify and respond to fraudulent charges within minutes rather than discovering them days or weeks later when reviewing your statement. Many banks offer customizable alert settings that let you choose to receive notifications via text message, email, or push notification based on your preferences.

Use virtual card numbers for online subscriptions and purchases rather than your actual debit or credit card number. Many credit card companies and digital payment services now offer the ability to generate temporary card numbers linked to your account but with different numbers that can be easily canceled if compromised. This approach isolates your primary card information from potential breaches at online retailers while still allowing you to make legitimate purchases and maintain subscriptions.

Review your credit reports regularly through AnnualCreditReport.com, which provides free access to your reports from all three major credit bureaus once per year. While credit reports don’t show individual bank account transactions, they reveal new accounts opened in your name, credit inquiries, and other activity that might indicate identity theft or fraud. Consider using a credit monitoring service that provides more frequent updates and alerts you to changes in your credit profile, helping you catch fraud attempts before they cause significant damage to your financial standing.

What to Do When You Find an Unauthorized S Charge

Immediate Steps to Take

Contact your bank or credit card company immediately when you identify an unauthorized s charge on your account. Most financial institutions have dedicated fraud departments available 24/7 to handle these situations quickly and protect your account from additional unauthorized transactions. Explain that you’ve found a charge you didn’t authorize, provide the specific transaction details including the date, amount, and merchant descriptor, and follow the representative’s instructions for filing a formal dispute or fraud claim.

Request that your bank issue a new card with a different number to prevent additional unauthorized charges from processing. While this step creates some inconvenience as you’ll need to update your card information with any legitimate subscription services or merchants where you’ve saved your payment details, it’s essential for stopping fraudsters who have obtained your card number. Most banks can expedite card replacement in fraud situations, delivering your new card within two to three business days or even offering same-day replacement at local branches.

Document everything related to the unauthorized s charge, including the date you noticed it, the date you reported it to your bank, the names of representatives you spoke with, and any case numbers or reference numbers provided during your conversations. Take screenshots of the charge as it appears in your online banking portal or mobile app, and save any email confirmations you receive regarding your fraud claim. This documentation proves essential if disputes become complicated or if you need to escalate the issue to higher levels of your bank’s customer service structure.

Understanding Your Consumer Protection Rights

Federal law provides strong protections for consumers dealing with unauthorized charges and billing errors on their accounts. The Fair Credit Billing Act gives credit card holders the right to dispute charges and withhold payment while investigations occur, with liability for unauthorized charges capped at fifty dollars if you report the fraud within a reasonable timeframe. For debit card fraud, Regulation E provides similar protections, though the timing of your report significantly impacts your potential liability, with immediate reporting limiting losses to fifty dollars, while delays of more than two business days can increase liability to five hundred dollars.

Banks must investigate disputed charges within specific timeframes established by federal regulations. For credit card disputes, issuers typically must acknowledge your claim within thirty days and resolve the investigation within two billing cycles or ninety days, whichever comes first. During the investigation, the disputed amount should be removed from your balance so you’re not required to pay charges while their legitimacy is being verified. Debit card disputes follow similar timelines, with banks generally required to provide provisional credit within ten business days while they complete their investigation.

File a complaint with the Consumer Financial Protection Bureau if your bank fails to handle your unauthorized s charge dispute appropriately or if you encounter resistance when trying to report fraud. The CFPB maintains a comprehensive database of consumer complaints about financial institutions and can help facilitate resolution when banks don’t follow proper procedures. You can submit complaints online through the CFPB website, and the bureau will forward your complaint to the financial institution and work to obtain a response addressing your concerns.

Preventing Future S Charge Confusion

Creating a Personal Financial Tracking System

Establish a comprehensive system for tracking all your subscriptions, recurring charges, and service fees to prevent confusion when s charges appear on your statements. Use a dedicated spreadsheet or subscription management app to record every recurring payment, including free trials that will convert to paid subscriptions after promotional periods end. Include detailed information about each service such as the billing frequency, cost per billing period, renewal date, cancellation process, and how the charge appears on your statement. Update this tracking system immediately whenever you sign up for new services or cancel existing subscriptions.

Set calendar reminders for free trial end dates, subscription renewals, and annual payments that might catch you off guard if you forget about them. Many subscription services make cancellation intentionally difficult by requiring you to cancel before the renewal date rather than allowing cancellation any time during the billing period. Calendar alerts give you sufficient advance notice to evaluate whether you want to continue each service and complete the cancellation process if you decide to stop paying for it.

Review your complete list of subscriptions quarterly to identify services you no longer use or need. The average American household now spends several hundred dollars per month on subscription services, with many people maintaining subscriptions they rarely or never use simply because they forget to cancel them. This quarterly review helps you eliminate unnecessary expenses and ensure you’re getting value from every recurring charge on your accounts. Consider consolidating services where possible, such as using one streaming platform instead of three, or finding single comprehensive services that replace multiple specialized subscriptions.

Setting Up Effective Banking Alerts and Monitoring

Configure transaction alerts that notify you immediately when charges process on your accounts. Most banks offer various alert types including notifications for every transaction, alerts when your balance drops below a specific threshold, notifications when large transactions occur, and alerts when international charges process. While receiving notifications for every transaction might seem excessive, this level of monitoring provides maximum protection against fraud and helps you maintain constant awareness of your financial activity.

Use budgeting software or apps that automatically categorize your transactions and help you identify spending patterns over time. Services like Mint, YNAB (You Need A Budget), or Personal Capital connect to your bank accounts and credit cards, pulling transaction data and organizing it into categories that show where your money goes each month. These tools make it much easier to spot unexpected charges because you can quickly see when spending in a particular category increases or when charges appear in categories where you don’t normally spend money.

Enable two-factor authentication for online banking and any accounts where you store payment information to add an extra layer of security that protects against unauthorized access. Two-factor authentication requires you to provide a second verification factor, such as a code sent to your phone or generated by an authentication app, in addition to your password when logging in. This security measure significantly reduces the risk that fraudsters can access your accounts even if they somehow obtain your login credentials through phishing attacks or data breaches.

Industry Statistics and Data on Banking Charges

| Type of Charge | Average Cost | Frequency | Annual Impact |

|---|---|---|---|

| Monthly Maintenance Fee | $10-15 | Monthly | $120-180 |

| Overdraft Fee | $30-35 | Per Incident | Varies |

| ATM Out-of-Network Fee | $2-4 | Per Transaction | $50-100 |

| International Transaction Fee | 1-3% | Per Transaction | Varies |

| Subscription Services (Average per Household) | $273 | Monthly | $3,276 |

| Stop Payment Fee | $25-35 | Per Incident | Varies |

| Wire Transfer Fee | $15-50 | Per Transaction | Varies |

Recent research indicates that American consumers spend an average of $273 per month on subscription services, totaling more than $3,000 annually. This figure has increased steadily over the past five years as subscription-based business models have proliferated across nearly every industry from entertainment and software to meal kits and personal grooming products. Many consumers significantly underestimate how much they spend on subscriptions, with surveys showing that people typically guess they spend less than half of what they actually pay when asked to estimate their monthly subscription costs without reviewing their bank statements.

Banking fees collectively cost American consumers approximately $34 billion annually, with overdraft and insufficient funds fees representing the largest category of charges. Research by consumer advocacy organizations has found that a small percentage of account holders pay the majority of overdraft fees, with individuals who frequently overdraft their accounts paying hundreds or even thousands of dollars per year in these charges. This concentration of fees among vulnerable consumers has sparked regulatory scrutiny and prompted some banks to eliminate or reduce overdraft fees in recent years.

Studies show that consumers who regularly monitor their bank accounts and credit card statements identify fraudulent charges an average of three days faster than those who only review their statements monthly or less frequently. This faster detection reduces the average financial impact of fraud and increases the likelihood that banks can recover funds or prevent additional unauthorized transactions. Research also indicates that people who use transaction alerts discover unauthorized charges within hours rather than days, providing the best possible outcomes when dealing with fraud.

Real-World Case Studies of S Charge Issues

Case Study 1: The Forgotten Subscription

Sarah, a marketing professional in Chicago, noticed her monthly budget seemed tighter than expected despite no significant changes in her spending habits. When she conducted a thorough review of her bank statements covering the previous six months, she discovered five different subscription charges that she had either forgotten about or didn’t realize had converted from free trials to paid services. These charges included a meditation app she used twice, a cloud storage service that duplicated functionality she already had through another provider, a premium music streaming subscription when she primarily used a different service, and two different online course platforms where she’d signed up for single classes but unknowingly enrolled in monthly memberships.

The cumulative impact of these forgotten subscriptions amounted to $127 per month, or more than $1,500 per year that Sarah was spending without receiving any value in return. Many of these charges appeared on her statements with generic s charge descriptors that didn’t immediately indicate which service was billing her account, contributing to her failure to notice them sooner. After identifying all the unnecessary subscriptions, Sarah contacted each company to cancel her memberships, and she created a comprehensive spreadsheet to track all her remaining subscriptions with renewal dates and costs clearly documented.

This case illustrates how easily subscription charges can accumulate without consumers realizing the total financial impact. The subscription business model relies partially on consumer inertia, with companies knowing that many customers will continue paying for services they don’t actively use simply because they forget to cancel or find the cancellation process too cumbersome to complete. Sarah’s experience demonstrates the importance of regular financial reviews and maintaining organized records of all recurring charges on your accounts.

Case Study 2: Third-Party Processor Confusion

James, a small business owner in Austin, discovered a series of s charges on his personal credit card that he couldn’t identify based on the transaction descriptors alone. The charges appeared as “S*DIGITAL SERVICES” with reference numbers but no clear indication of which merchant had processed the transactions. James initially worried that his card information had been compromised and that these represented fraudulent charges, prompting him to call his credit card company to dispute the transactions and request a new card.

During the investigation process, James’s credit card company provided additional details about the charges including the full merchant name and contact information that hadn’t appeared on his statement. James realized that these s charges were actually legitimate purchases he had made from small online retailers who processed their payments through a third-party payment platform. One charge was for a custom phone case he’d ordered from an Etsy seller, another was for a digital template he’d purchased for his business presentations, and a third was for a small software tool he’d bought to help with project management.

This case highlights how third-party payment processors create confusion by using generic billing descriptors instead of showing the actual merchant names that consumers would recognize. James’s experience demonstrates the importance of contacting your financial institution for detailed information before assuming charges are fraudulent, as the additional details available to bank representatives often clarify transactions that appear mysterious on your statement. The incident also illustrates why keeping digital receipts and purchase confirmations organized is valuable, as James could have avoided the stress and inconvenience of disputing legitimate charges if he had maintained better records of his online purchases.

Case Study 3: Banking Fee Surprise

Maria, a college student in Los Angeles, began noticing monthly s charges of $12 on her checking account statement. She initially assumed these were related to a subscription service she’d signed up for, but after reviewing her email and checking her active subscriptions, she couldn’t identify any service that cost exactly $12 per month. After three months of these mysterious charges, Maria contacted her bank to inquire about them and discovered they were actually monthly maintenance fees her account had started incurring.

When Maria had opened her student checking account two years earlier, it came with no monthly fees as long as she maintained her student status. However, after graduating and updating her information with the bank, her account had automatically converted to a standard checking account that included a $12 monthly maintenance fee unless she maintained a minimum daily balance of $1,500 or had direct deposits totaling at least $500 each month. Maria didn’t meet either requirement, so the fees had started accruing monthly without her realizing what was happening because the charge descriptor wasn’t immediately clear about its source.

Maria was able to resolve the situation by switching to a different account type offered by her bank that had no monthly fees and fewer balance requirements. The bank also refunded two of the three maintenance fees she’d been charged since she genuinely hadn’t understood that her account type had changed and that fees would apply. This case study illustrates how important it is to understand your bank account’s fee structure and to recognize that account terms can change based on your circumstances or status. Many banks offer multiple account types with varying fee structures, and taking time to compare options can save significant money over time.

How Different Financial Institutions Handle S Charges

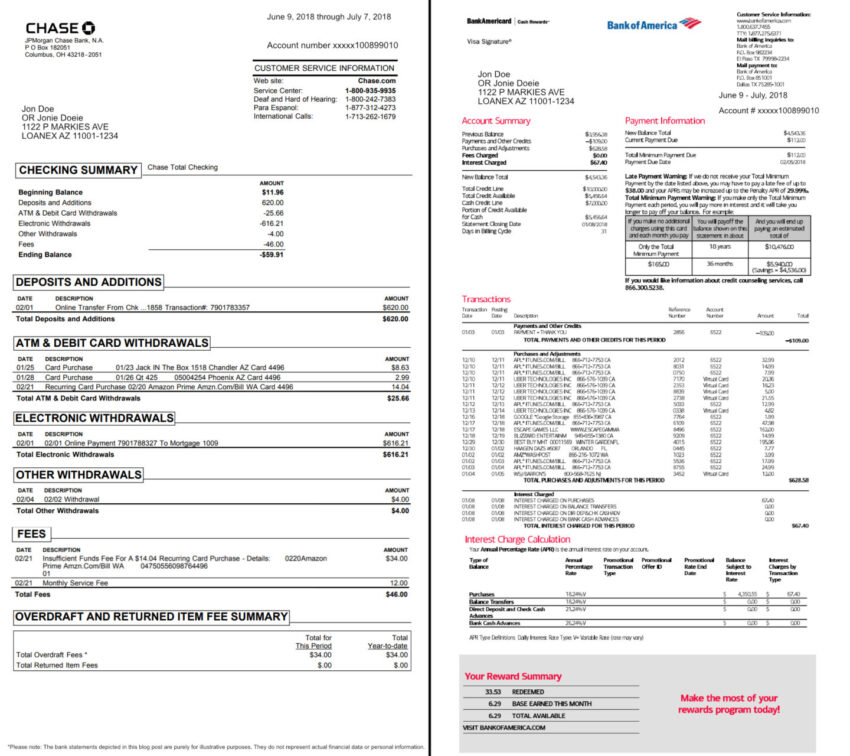

Traditional Banks

Major national banks like Chase, Bank of America, Wells Fargo, and Citibank process thousands of different types of charges daily, using standardized codes and descriptors to manage their massive transaction volumes. These institutions typically use s charge designations for their service fees including monthly maintenance charges, overdraft fees, and various transaction-based fees. The specific descriptor format varies by bank, with some institutions providing more detailed information directly on statements while others require customers to log into online banking or contact customer service for additional transaction details.

Traditional banks generally offer robust customer service infrastructure to help account holders understand charges and resolve disputes. These institutions maintain 24/7 phone support, extensive online help resources, mobile app messaging features, and physical branch locations where customers can speak with representatives in person. When dealing with mysterious s charges at major banks, customers typically have multiple channels available to get questions answered and issues resolved, though the quality and responsiveness of service can vary significantly between institutions and even between different representatives at the same bank.

Online and Digital Banks

Digital-only banks like Chime, Ally Bank, Varo, and Current typically charge fewer fees than traditional banks, which means their customers encounter s charge service fees less frequently. These institutions build their business models around minimal fees, often eliminating monthly maintenance fees, overdraft fees, and other common charges that traditional banks impose. However, customers of online banks still see s charge descriptors for subscription services, third-party payment processor transactions, and the occasional fees that digital banks do charge such as expedited card replacement or certain types of wire transfers.

Online banks typically provide detailed transaction information through their mobile apps and websites, often including merchant logos, transaction categories, and enhanced descriptions that help customers identify charges more easily. These digital-first institutions recognize that their customers primarily interact with their accounts through apps rather than visiting physical branches, so they invest heavily in making their digital interfaces informative and user-friendly. Many online banks also offer innovative features like instant transaction notifications, spending insights, and automatic savings tools that help customers maintain better awareness of their financial activity.

Credit Unions

Credit unions, being member-owned nonprofit institutions, typically charge lower fees than traditional banks and often provide more personalized service to help members understand their accounts. These institutions process s charges for subscriptions and third-party transactions just like other financial institutions, but their approach to service fees tends to be more conservative and member-friendly. Many credit unions offer free checking accounts with no monthly maintenance fees and lower-than-average charges for services like overdrafts, ATM usage, and stop payments.

The smaller size of most credit unions compared to national banks means they can often provide more individualized attention when members have questions about charges or need help resolving issues. Credit union representatives frequently have more flexibility to waive fees in special circumstances or work with members who are experiencing financial difficulties. However, credit unions may have less sophisticated digital banking platforms than larger institutions, potentially making it harder to access detailed transaction information through mobile apps or websites, though this gap has been closing as credit unions invest more heavily in their technology infrastructure.

The Future of Transaction Descriptors and Banking Transparency

The banking industry is gradually moving toward more transparent and consumer-friendly transaction descriptors in response to customer frustration with generic codes like s charge that provide little useful information. Payment card networks and financial technology companies are developing enhanced descriptor standards that allow more detailed merchant information to appear on statements and in banking apps. These improvements include showing merchant logos, full business names, transaction locations, and links to digital receipts directly within the transaction details consumers see when reviewing their accounts.

Open banking initiatives and regulatory changes in various countries are pushing financial institutions to provide customers with better access to their data and more control over how they share their financial information. These developments are creating opportunities for third-party apps and services that help consumers better understand their spending, identify unusual charges more easily, and manage subscriptions more effectively. As open banking becomes more prevalent, consumers will likely have access to tools that automatically identify and categorize all their transactions with much greater accuracy than current systems provide.

Artificial intelligence and machine learning technologies are being deployed by banks and financial technology companies to improve fraud detection and help customers understand their transactions. These systems can learn individual spending patterns and flag unusual charges for review, potentially identifying fraudulent s charges before customers even notice them. AI-powered assistants within banking apps may soon be able to answer questions about specific charges, explain fee structures in plain language, and provide personalized recommendations for avoiding unnecessary fees based on each customer’s account usage patterns.

Frequently Asked Questions About S Charges

What does an s charge on my bank statement mean?

An s charge on your bank statement typically indicates a service fee from your bank, a subscription payment to a service you’ve signed up for, or a transaction processed through a third-party payment processor whose name begins with S. The exact meaning depends on the specific amount, date, and any additional information in the transaction descriptor. Review your recent purchases, active subscriptions, and bank fee schedule to identify which category the charge falls into.

How can I find out what an s charge is for?

You can identify an s charge by contacting your bank’s customer service department and asking for detailed information about the specific transaction, including the full merchant name and contact information. Additionally, review your email for purchase confirmations or subscription renewals around the date of the charge, check your list of active subscriptions against the charge amount, and search online for the exact descriptor that appears on your statement, as other consumers may have encountered and identified the same charge.

Are s charges always legitimate?

No, s charges are not always legitimate. While many s charges represent valid transactions such as subscription services, bank fees, or purchases processed through third-party payment platforms, fraudulent charges can also appear with s charge descriptors. Always investigate any s charge you don’t recognize and contact your bank immediately if you determine a charge is unauthorized. Monitor your accounts regularly to catch fraudulent charges quickly and minimize their financial impact.

Can I dispute an s charge?

Yes, you can dispute any s charge that you believe is unauthorized, incorrectly charged, or fraudulent. Contact your bank or credit card company as soon as possible to report the questionable charge and initiate a dispute. Federal law provides consumer protections for unauthorized charges and billing errors, limiting your liability if you report problems promptly. Keep detailed records of all communication with your financial institution regarding disputed charges.

How do I prevent unexpected s charges?

Prevent unexpected s charges by maintaining a detailed list of all your active subscriptions with renewal dates and costs, setting up transaction alerts through your bank to notify you of every charge immediately, reviewing your bank statements at least weekly to catch unusual charges quickly, canceling free trials before they convert to paid subscriptions, and using virtual card numbers for online purchases to protect your primary card information from potential breaches.

Why do subscription services show up as s charges?

Subscription services often appear as s charges because they process payments through third-party billing platforms or payment processors that use standardized, abbreviated transaction descriptors. These systems have limited character space for merchant names and use codes that help them process millions of transactions efficiently across different payment networks. The “s” prefix might stand for subscription, service, or simply be part of the abbreviated merchant name.

What should I do if I keep getting charged for a subscription I canceled?

If you continue seeing charges for a subscription you believe you canceled, first verify that you actually completed the cancellation process by checking for a confirmation email or reviewing your account on the service provider’s website. If you did cancel properly but charges continue, contact the company directly to request a refund and confirm cancellation, then contact your bank to dispute the charges if the company doesn’t resolve the issue. Consider changing your card number to prevent future charges if the company refuses to stop billing you.

How long does it take to resolve a disputed s charge?

Banks typically must acknowledge your dispute within 30 days and resolve the investigation within two billing cycles or 90 days for credit card charges. For debit card disputes, banks generally provide provisional credit within 10 business days while completing their investigation. The actual timeline can vary depending on the complexity of the situation, the responsiveness of the merchant involved, and whether the bank needs to request additional information from you during the investigation process.

Take Control of Your Finances Today

Don’t let mysterious s charges drain your bank account without your knowledge. Start monitoring your accounts daily using your bank’s mobile app, set up transaction alerts to notify you of every charge immediately, and create a comprehensive list of all your active subscriptions with renewal dates and costs. Review your complete transaction history right now to identify any s charges you don’t recognize, and contact your bank to investigate anything that seems suspicious or unauthorized.

Taking these proactive steps protects your financial security and ensures you’re only paying for services you actually use and value. Remember, understanding every charge on your statement isn’t just about catching fraud—it’s about taking complete control of your financial life and making informed decisions about where your money goes each month.

Sources:

- Consumer Financial Protection Bureau – Understanding Your Bank Statement: https://www.consumerfinance.gov/

- Federal Trade Commission – Disputing Credit Card Charges: https://www.ftc.gov/

- American Bankers Association – Banking Fees and Services Report (2024)

- Financial Technology Association – Payment Processing Standards and Best Practices